Whether you are a business owner or an investor, if you do not understand the three basic financial statements of a company, you may not be equipped to make smart choices, unless you’re like Gladstone Gander and possess exceptional good luck.

In this article, I have tried to summarise what I know about the three important business statements to the best of my abilities and tried to make it as easy as possible for you to get a good grasp of it. What I suggest is for you to go through each of the statement individually and then read this article so you can learn to effectively connect the dots.

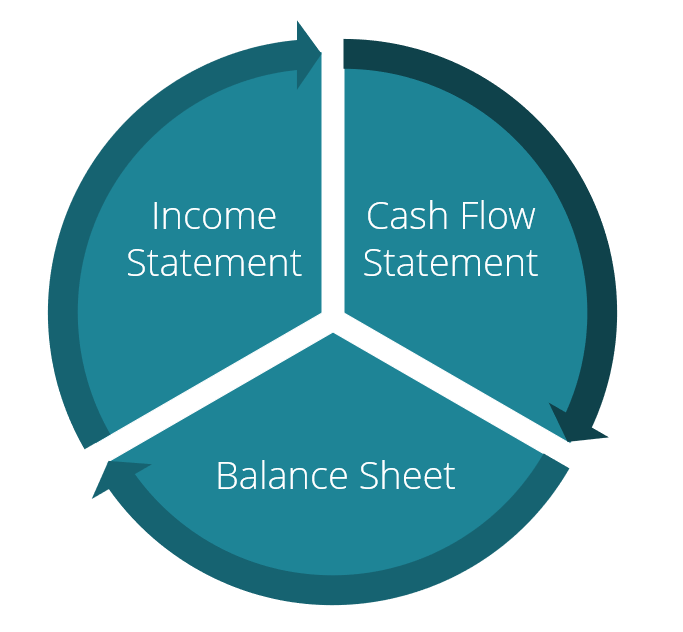

The Three Statements:

When the sales in the income statement is recorded, it either increases asset or decreases the liability which is recorded in the balance sheet. This makes the income statement and the balance sheet closely related. The changes in the balance sheet accounts during the year help derive the numbers in the statement of cash flows. Thus, the three primary financial statements of a business are intertwined and interconnected.

Below are the 3 financial statements of Amazon as an example and reference for the next sections of the article.

To ensure a company has healthy financials it needs to be strong in these three aspects:

-

Show a good net income- The net income is the starting point of the analysis. Also called the bottom-line of a company, it indicates profitability once all costs, expenses, depreciation, tax, interest etc are deducted. Although this is a good indicator, it does not end here.

-

Strong balance sheet- This is arguably the most important of the 3 financial statements to understand the health of a business. It is also known as score card or report card for a business. It gives a detailed report of the assets, liabilities & equity, and gives an estimate of the debt vs equity ratio (calculated by dividing a company’s total liabilities by its shareholder equity- ideal ratio is between 0.5-2 depending on the industry) and the working capital (the difference between current assets and current liabilities which needs to be positive).

-

Positive net cash flow- This means a business has made more cash than it has spent on its activities. The cash flow statement is divided into cash flow from operating activities, investing activities and financing activities. For a growing business the net cash flow from operating activities must be a positive value while the other two can be negative.

Here is a chart color coded to represent all the items under each financial statement that are interlinked.

-

Making sales allows business to maintain cash balance. Any sales on credit generates accounts receivable and this means increase in accounts receivable in the cash flow statement which is debited.

-

Cost of goods sold- when a business buys products and are unused they are stored in inventory. The inventory is decreased or credited in cash flows when a product is used to make a sale, also called cost of goods expense in the income statement. If the products are bought on credit, it adds to accounts payable in the balance sheet and is noted as an increase or credit in the cash flow.

-

Depreciation & Amortization- Depreciation is recorded for fixed assets & amortisation for intangible assets such as patents. Depreciation does not reduce the fixed asset itself but is recorded in a different account as accumulated depreciation. The Capital expenditure accounts in cash flow statement maintains the credit for the purchase of the fixed assets (Property, plant and equipment).

-

Operating Expenses-These include broad range of expenses like selling, administration & other general expenses. They are distributed across prepaid expenses (when costs are prepaid before recording expense), Accounts payable (when purchases are made on credit), & accrued expenses payable (For all the unpaid expenses).

-

Interest Expense- Borrowing money from short term and long term notes causes the interest expense or income.

-

Income tax Expense- When income tax is unpaid at the year end, it is recorded under accrued expense liability.

-

Net Income- A positive net income increases retained earnings, which is also the starting point of a statement of cash flows. “Bottomline” of a statement is the net cash increases or decrease from the 3 types of activities in a cash flow statement, which is the increase in cash during year. When sufficient cash flow from profit is generated it can afford to pay cash dividends to share-owners.

If you can get a good grasp of the above concepts, you should be able to read the financials of any company. It takes time, but practice and determination is all that is required.

Other Articles by Priya: